reit tax advantages canada

REITs allow investors to pool resources to invest in real estate which can include portfolios of commercial industrial residential and other types of properties. It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings hospitals.

A REIT gets the preferential tax treatment of an income trust which means it is not subject to corporate tax.

. In principle REITs like the business income and royalty trusts of yesteryear improve capital market efficiency in this sense. In Canada a REIT is not taxed on income and gains from its property rental business. REITs are not taxed on.

The clear advantage of a REIT is to reduce corporate and. REITs are qualified investments for RRSPs RRIFs and TFSAs. When reinvested the rate rises to 42.

Since REITs are required to pay 90 of the income back to investors only 10 of the taxable capital can be invested back into REIT and other holdings. On the subject of REIT taxation an article in the Financial Post states. In 2026 the rate will increase to 66 but there will be a separate 31 increase.

True North Commercial TSXTNTUN trades at less than 10 744 per share but pays an ultra-high 802 dividend. Trade shares in commercial real estate without lockups no more holding periods. 2 Stability REITs tend to hold only large portfolios of stable business interests.

REITs offer certain tax advantages to encourage this investment. 3 Tax benefits The. How is the REITs market evolving in Canada.

This 63899 million REIT owns and operates 45 commercial properties. They do this to avoid paying tax inside the. There is no legislation governing the organizational structure of a REIT.

There is no immediate tax to pay on it as it simply reduces the cost of the share. If it pays a dividend to shareholders thats. Ad Sign up for a free account today to access our live commercial real estate funds.

Principles of contract law and trust law govern. Ad Analyze investments via suite of research tools offering property details data more. REITs encourage capital formation and allow small investors to participate in the ownership of all real estate asset types on the same basis as the wealthy do but.

It can take years to save for a down payment and even then the rise in real estate prices. The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit holders. Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet.

REIT Tax Benefits No. There is no withholding tax on distributions by the REIT to residents of Canada. REITs are good for the Canadian economy.

As ordinary income a majority of REIT dividends return to 396. Homeownership in Canada is becoming increasingly unaffordable. When a typical corporation makes money it has to pay taxes on its profits.

Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet. Ad Sign up for a free account today to access our live commercial real estate funds. Pros of REIT investment.

Low capital appreciation. Benefit from preferential tax treatment trust income is permitted to flow through. Your REIT Income Only Gets Taxed Once.

The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors 1 A report. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

ROC is referred to as a reduction in adjusted cost base or. It requires a good stock tracking system. However income distributions to nonresidents will attract a 25 withholding tax and nonincome distributions.

The 293 billion REIT is the lone real estate stock in the cure sector. They are less likely to suffer significant losses due to economic downturns. As REIT dont pay tax on the dividend they tend to offer higher distributions.

The fact that they act as flow-through vehicles with no tax at the trust level makes them particularly attractive.

Best Canadian Reit Etfs Real Estate Etfs For Dividends Passive Income Investing Tfsa Rrsp Youtube

Retirement Accounts Versus Real Estate Podcast 168 Should You Pull Money Out Of Retir Retirement Accounts Real Estate Investment Trust Real Estate Investing

Opportunity Zone Austin Commercial Real Estate Investing Commercial Real Estate Real Estate Sales

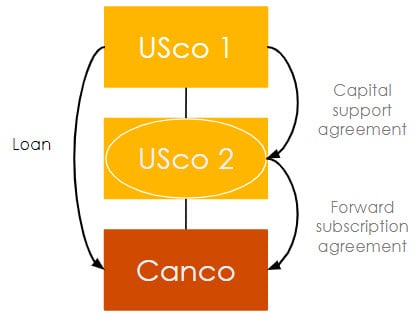

Tax Insights Canada Introduces First Package Of Hybrid Mismatch Rules Pwc Canada

Retirement Accounts Versus Real Estate Podcast 168 Should You Pull Money Out Of Retir Retirement Accounts Real Estate Investment Trust Real Estate Investing

Ce Course After Tax Returns How To Estimate The Impact Of Taxes On Etf Performance Advisor S Edge

How To Have More Money Investing For Beginners Money Management Advice Money Saving Strategies Money Strategy

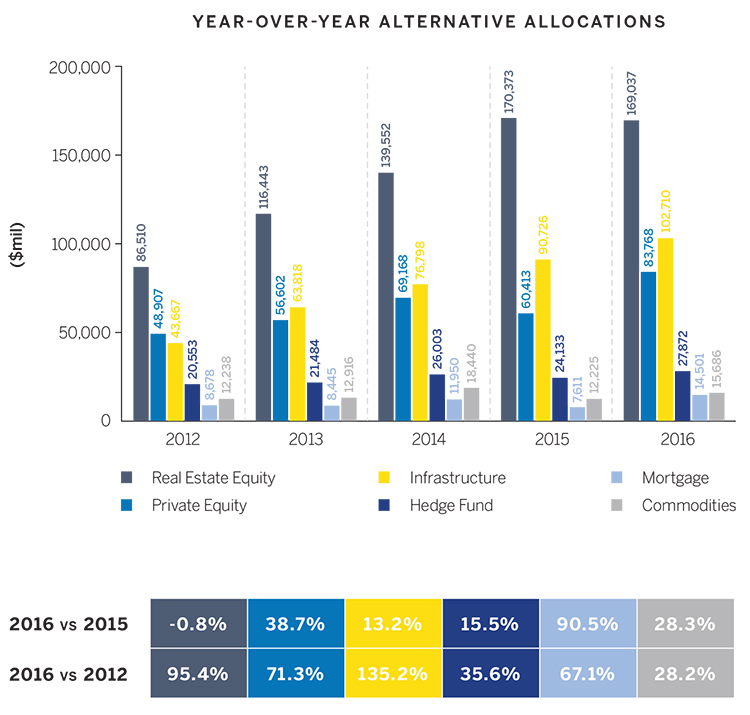

Is Real Estate On Your Radar Benefits Canada Com

Secret Tax Hacks Money Management Investment Quotes Real Estate Investor

Retirement Accounts Versus Real Estate Podcast 168 Should You Pull Money Out Of Retir Retirement Accounts Real Estate Investment Trust Real Estate Investing

Perfecting The Perfect Portfolio Part Ii Canadian Portfolio Manager Blog

5 Reasons The S P 500 Is Higher Today Indexsp Inx Stock Market Investment Loss Stocks To Watch

How To Calculate Capital Gains Tax For Greater Understanding

Best Canadian Reit Etfs Real Estate Etfs For Dividends Passive Income Investing Tfsa Rrsp Youtube

Return Of Capital And How It Affects Adjusted Cost Base Adjusted Cost Base Ca Blog

Two Days Left To Pay Second Instalment Of Advance Income Tax For Fiscal 2019 Income Tax Senior Discounts Income Tax Return

Retirement Accounts Versus Real Estate Podcast 168 Should You Pull Money Out Of Retir Retirement Accounts Real Estate Investment Trust Real Estate Investing